Respected individuals,

I believe that the opposition political parties and people’s movements in India do not have any doubt that rampant corruption and violations of rules are behind the phenomenal rise in the financial growth of a few business oligarchs in India over the past decade. While it is true that the Indian political sphere has never been free from crony capitalism, over the last ten years, it has crossed all boundaries and reached a point where the country’s public wealth is being distributed only to a handful of oligarchs.

Reports say that the Gautam Adani’s business empire’s growth is a staggering 1830% in just the last decade. Mukesh Ambani’s wealth has seen a 350% increase, and Patanjali under Baba Ramdev has witnessed a 173% growth during this period. Patanjali Group, which is currently facing shame in court for misleading people and selling medicines with false information, has seen its assets reach a whopping Rs 70,000 crore during this time.

Adani can be taken as a prime example of the growth of Indian oligarchs under the Modi government.

Serious irregularities can be found in all the sectors Adani has forayed into, including mining, energy, ports, airports, and infrastructure development. We have seen numerous pieces of evidence come to light regarding Gautam Adani manipulating the stock market. Most recently, even SEBI, the official body that regulates the stock market in the country, was forced to reveal that around 12 investors in Adani’s companies have dubious backgrounds, despite all efforts to keep them hidden.

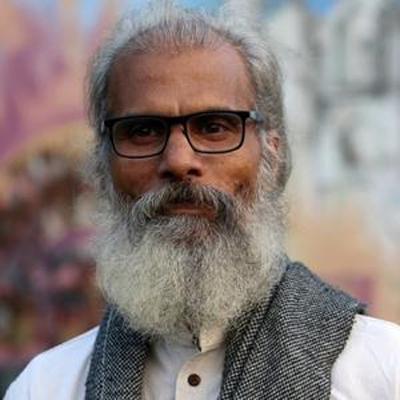

Gautam Adani

Reports have surfaced regarding the government’s actions that allegedly benefit the Adani Group, including granting them access to coal mines, requiring power plants to buy coal from their companies, and making regulatory changes in ports and airports to their advantage.

Individuals who defrauded public sector banks and fled the country have burdened the banks with nearly Rs 10 lakh crore.

This massive burden, categorized as non-performing assets (NPAs), is the result of defaults by a mere 28 individuals.

The banks’ NPAs have skyrocketed from Rs 2 lakh crore in 2014 to over Rs 10 lakh crore in 2024.

The government has reportedly taken no action to extradite or seize the assets of these loan defaulters, including Vijay Mallya, Nirav Modi, and Mehul Choksi.

Under the guise of promoting industrial growth and job creation, the Modi government has granted tax breaks worth a staggering Rs 16 lakh crore to India’s ultra-wealthy over the past decade. This immense sum, equivalent to the amount that could have fueled substantial investments in education and other sectors capable of generating employment opportunities for millions of India’s youth, has instead been handed out as tax breaks to the super-rich.

Examining unemployment statistics reveals the ineffectiveness of these so-called ‘tax breaks’ in addressing India’s unemployment crisis.

Government data clearly indicates that youth unemployment is at an all-time high, contradicting the claims of a job-friendly environment created by these incentives.

Reports from various sectors highlight the stark inequality prevalent in several areas, including wealth distribution, tax collection, and subsidy allocation.

A press release issued by the Press Information Bureau on May 1, 2023, claimed that the country’s Goods and Services Tax (GST) collection had reached an all-time high. The government asserts that Rs 1.87 lakh crore was collected in tax revenue in April 2023.

While the reported increase in tax collection might seem significant, a closer look at the breakdown reveals a concerning pattern.

A staggering 64% of the aforementioned GST revenue is collected from the most vulnerable section of society – the bottom 50% of income earners. The remaining 33% of the tax burden falls on the middle class, comprising 40% of the population. Alarmingly, only 3% of the total tax is collected from India’s top 10% wealthiest individuals.

It’s evident that vested interests are deliberately withholding this information from the public while making lofty claims about the rise in tax collection.

Everyone prefers to view the country’s rising inflation as simply a global phenomenon. However, former Reserve Bank Deputy Governor Viral Acharya took a different stance, directly naming five major domestic corporations as significant contributors to the persistent inflation: Adani Group, Reliance Industries, Tata Group, Aditya Birla Group, and Bharti Telecom. (Source: ‘pricing power of big 5 driving core inflation; Viral Acharya, March 13, 2023’)

It is often the members of the opposing political parties that raised allegations both in and out of legislative bodies about the corrupt actions of the government for the businesses that stand with the government. It is the people’s movements in the country that are protesting against large corporations that are plundering the country’s public resources.

The opposition political movements have a responsibility to seize the public wealth that has been illegally acquired by a tiny minority of ultra-wealthy oligarchs, including the companies mentioned earlier, in order to improve the country’s economic situation.

It is also time for the opposition to declare their commitment to canceling all illegal contracts and concessions made by the Modi government, recovering public wealth illegally acquired by large corporations, and confiscating the assets of ultra-wealthy individuals who have fled abroad.

Translated by Midhaa Thahani M.

CONTENT HIGHLIGHTS: An Appeal for Indian Opposition Parties